Debit vs. Credit Cards

A little while ago, I was having a conversation with a few of my friends when the topic of debit and credit cards came up. My friends and I are between the ages of 18-20 years old. I thought that by that age, everyone would know the difference between a debit card and a credit card.

That wasn't the case.

One of them knew the basic difference, but didn't understand the benefits and negatives between the two.

One of my friends had absolutely zero idea. Well she actually knew one thing. The conversation follows between her and I.

"... doesn't credit cards have something to do with a type of score... uh... I think credit score."

"Yeah that's right. Do you know what a credit score is or what it does for you?"

"... ... ... I thought only old adults are supposed to know."

Now I'm not going to fault her. In her defense, where are you supposed to learn that information naturally. Most schools don't teach that or any sort of basic financial knowledge (they really should IMO), and a lot parents simply don't teach their kids about that because in there eyes, they're kids.

The reality is, knowing and understanding this type of basic financial knowledge is important, especially at that age of those in high school and college.

Now if you're older than that, that's completely fine. It's great that you're here and wanting to learn; putting a step forward to learning fundamental financial knowledge that everyone should know.

Now let's get into the main difference.

Debit Card Definition

"A debit card is a payment card that deducts money directly from a consumer’s checking account when it is used."(1) To make that definition simpler: you put money into a bank through your checking's account, and by using a little plastic card, you can purchase goods with that money in the bank.

Debit cards makes 'carrying' money extremely convenient.

For example, let's say you had $20,000 to your name. Which would you prefer to do, walk around everyone you went with two hundred $100 bills in your wallet/ purse, or carry a tiny plastic/metal card.

That's the glorious things about debit cards and why most people own one: convenience.

Anytime, anywhere (where they take card), you can pull out that little piece of plastic and pay for something.

Debit cards are simple and pretty straightforward. Credit cards are a tiny bit more complicated.

Credit Card Definition

"A credit card is a thin rectangular piece of plastic or metal issued by a bank or financial services company that allows cardholders to borrow funds with which to pay for goods and services with merchants that accept cards for payment."(2)

To make it easy to understand: a credit card is use to borrow money from the bank to make purchases, and you get a grace period of at least 21 days to pay the bank back; although, with most credit cards and banks they give you 30 days.

To put it even more simply, it's a loan; the shortest loan.

Credit cards carry the convenience just like a debit card but instead of pulling money out of your checking's, instead you're using the bank's money in the form of a loan with a grace period.

The grace period of a credit card is the period in which you won't be accrued interest on the money you borrowed. The amount of interest you must pay if you go over the grace period varies by credit cards in the form of APR.

"APR is expressed as a percentage that represents the actual yearly cost of funds over the term of a loan or income earned on an investment."(3) The average credit card APR is 16.27% as of the end of Q3 2022.(4)

What does that mean?

Let's use an example. You have a credit card that has 15.99% APR, and gives you a 30 day grace period. You use your credit card to purchase a $200 pair of shoes. If you pay off the card, the full $200, within 30 days, you owe nothing extra to the bank.

However, let's say you don't pay it back within the 30 day grace period. The interest that will be add to $200 is... $2.67.

Now you might be thinking that isn't a lot, which is true. However, interest builds up gradually over time.

Let's say you don't pay off your card for the next month after. Your interest % won't be based off of $200, but instead $202.67. Making the next month's balance of $205.37.

Still not a lot right? But in this specific example, the only purchase you've made with that credit card is the $200 shoes.

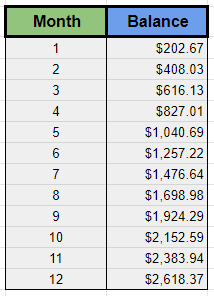

Let's say every month you spend $200 for an entire year and you decide to not pay off your card (ignoring minimum payment). In total spending $2400 in the year. We'll use a table to clearly show how much the interest can stack.

After 12 months, your total balance comes out to $2618.37; $218.37 on just interest. An extra $218.37 you must pay unless you want that total to keep increasing exponentially.

The lesson here: pay your credit cards in time!

Conclusion

The main difference between a debit card and a credit card isn't that complicated. One allows you to take your own money from your checking's to make purchases, the other allows you to take a short-term loan to make purchases.

Article Sources

- Investopedia. "Debit Card Definition, Fees, and How They Work," https://www.investopedia.com/terms/d/debitcard.asp

- Investopedia. "Credit Card: What It Is, How It Works, and How to Get One," https://www.investopedia.com/terms/c/creditcard.asp#citation-1

- Investopedia. "Annual Percentage Rate (APR): What It Means and How It Works," https://www.investopedia.com/terms/a/apr.asp

- LendingTree. "Average Credit Card Interest Rate in America Today," https://www.lendingtree.com/credit-cards/average-credit-card-interest-rate-in-america/#:~:text=The average APR for all,the average stood at 15.13%25.